This page is part of my unofficial solutions manual to the GRE Paper Practice Book (2e), a free resource available on the ETS website. They publish the questions; I explain the answers. If you haven’t worked through the Practice Book, give Section 6 a shot before reading this!

6.13: Property Tax

This is another percent-difference problem, similar to 5.19. Last time, just to refresh your memory, we described the situation in terms of percent change, even though it was actually two different types of taxes we were comparing. Here’s the formula we used.

We can take a similar approach here. Because we’re asked to find our answer in terms of Patricia’s property tax, her tax will be the base, or denominator, in our calculations. The “change” will be the difference between Patricia’s and Steve’s respective property taxes. We’ll call Patricia’s tax P and Steve’s tax S.

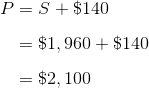

But before we can plug those figures into the formula, we need to figure out the value of P. We know S and we know the difference between the two, so we can use those two values together to solve for P:

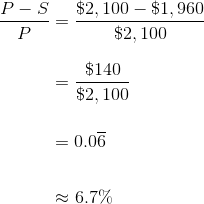

Now we just plug in P as our denominator, and the difference P – S (which we already know is $140) as our numerator:

Steve’s property tax is about 6.7 percent less than Patricia’s, so the answer is (A).

Math Review Reference

For more on this topic, see the following section of the GRE Math Review:

- 1.7: Percent (pp. 9-12)